A True Story of Rent Debt Resistance in LA

Landlords Are Cashing in on the Housing Crisis—Here’s How to Report Them

Most people believe eviction happens because someone failed to pay rent, slacked off, didn’t follow rules or didn’t try hard enough. That’s what I used to think, too. That is, until eviction happened to me.

I’m not lazy. I’m not irresponsible. I’m not a “bad tenant.” But I was tricked into a bad situation by a corporate landlord called Equity Residential (EQR).

EQR lures tenants into “luxury” apartments with low deposits. Once people are moved in, they raise the rent, ignore building repair needs, and then they throw Band-Aids on apartment fixes—all with minimal to no communication. That’s exactly what happened to me and my sister at The Hesby in North Hollywood.

To start, my sister and I are LA natives and artists. We were initially excited about living in North Hollywood. I’d go there often with friends while attending Cal State Northridge. But EQR didn’t see us as “neighbors” as they claimed. They saw us as numbers. EQR cut off communication after we fell behind on rent for one month during the onset of the COVID-19 pandemic. They ignored habitability issues like roaches, broken doors, and recurring break-ins; two months later, EQR served us an eviction notice. We were shocked and heartbroken.

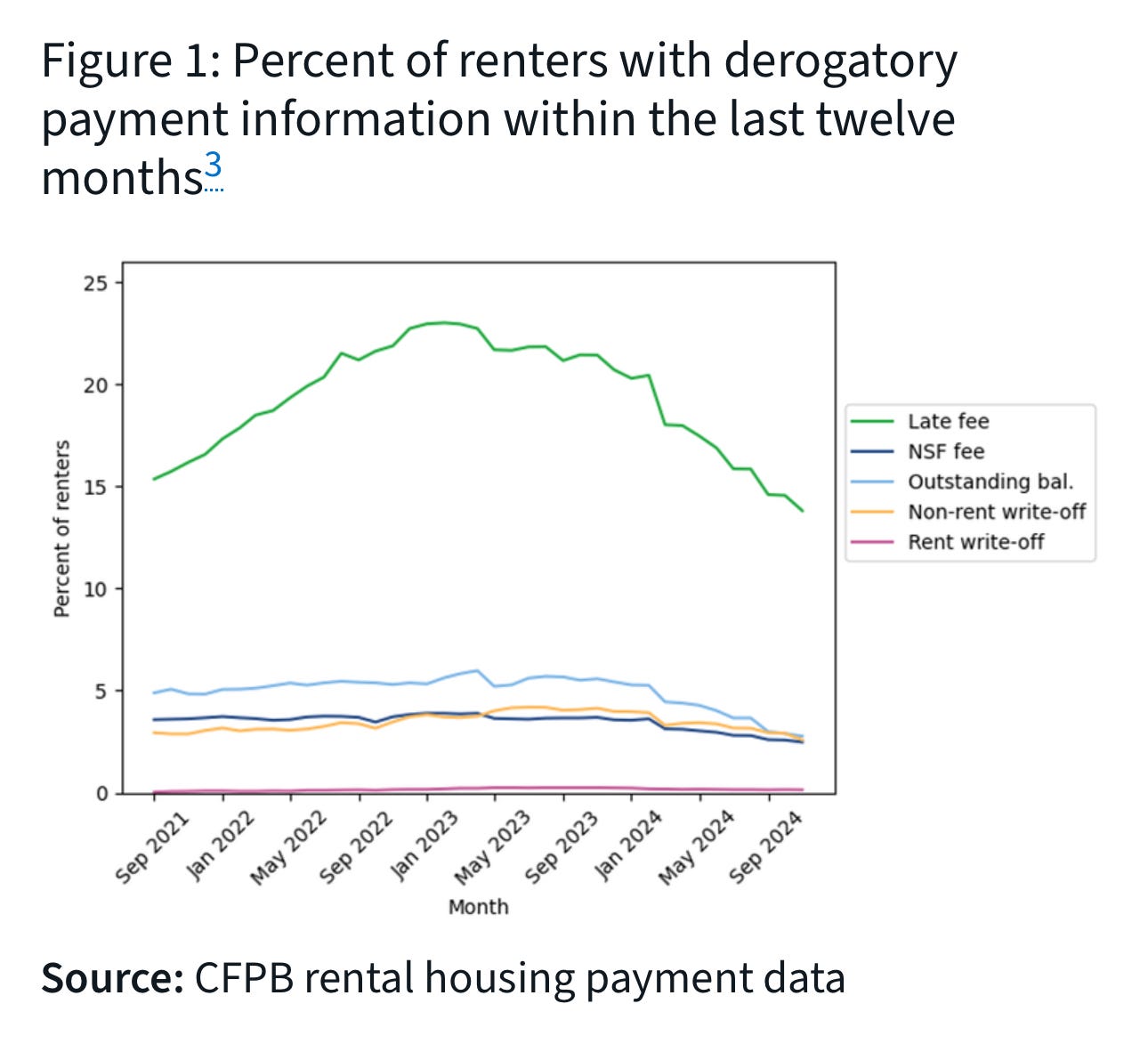

During our court session, we were asked whether we had rent relief (we did), only for EQR to refuse to accept it. They then took us through months and months of negotiations, rent debt growing as time passed. What I didn’t know was that we weren’t alone in this nightmare. In fact, 1 in 8 renters owes rent debt. We ended up losing our home. We lost our storage and all of our belongings. We ended up living in our car. And—to add insult to injury—we were left with almost $14,000 in rent debt, ruined credit, and trauma that we’re still trying to process. Our experience wasn’t a one-off. It’s actually EQR’s business model. EQR, and corporate landlords like them, actually profit from evictions, rent debt, and displacing people who fall victim to their predatory practices.

The Term “Corporate Landlord” Doesn’t Tell the Full Story

It’s no secret that California is in the midst of a full-blown housing crisis, and it’s hitting Black and brown Angelenos especially hard. Generations of anti-Black housing policies — from redlining to discriminatory lending — have made it difficult for Black families to access safe and affordable housing. Add on the fact that many working-class Angelenos are living paycheck to paycheck and cannot afford to be free to live, and it begins to feel like we’re navigating a cruel recurring nightmare of our ancestors—we’re “enslaved” to unstable work lives to keep our homes, to remain sheltered.

Today, corporate landlords like Equity Residential (EQR) are continuing a systematically racist legacy in a new form — using exploitative business practices to trap tenants in unstable housing, rising rent debt, and forced evictions. Behind it all is a deeper issue: housing is increasingly controlled by these corporations, turning our need for housing into a profit-making machine for already wealthy investors. In fact, the term “corporate landlord” doesn’t even tell the whole story. Many of these conglomerates are actually real estate investment trusts (REITs)—massive financial firms, by law, focused on maximizing returns for shareholders. Their business model doesn’t just de-prioritize tenants like my sister and me—it literally exploits us. EQR has used strategies including fake junk fees, algorithm-driven rent hikes, serial eviction, saddling evicted tenants with debt, and more. These are regular tactics to increase profits, not a last resort. A feature, not a bug, as the saying goes. So what can we do?

Fighting Back with the Landlord Reporting and Rent Debt Tool

After being evicted, my sister and I connected with Debt Collective and other tenant organizers who’d had their own horrible EQR stories. Our experiences became a point of connection; soon the despair that comes with eviction wasn’t a harm we had to navigate in isolation. In fact, finding community was our lifeline. The support and shared stories of other tenants were invaluable in our fight against EQR.

We spent the next year gathering as much info as possible about their shady practices. We attended meetings, spoke to journalists, learned our rights and our work culminated in a groundbreaking rent debt strike. Although the process was inspiring, our struggle isn’t over. The next stage of our organizing work is to get the word out about the Landlord Reporting and Rent Debt Tool. And we need your help.

Here’s how it works: let’s say you suspect your landlord is doing something illegal. Maybe your apartment has frequent issues like mold or bugs and your landlord fails to maintain a clean, safe or habitable environment. Take note. Perhaps your landlord keeps enforcing payment for services you and other tenants never use. Write it down. Has your landlord ever used deceptive pricing, hidden fees and excessive rent increases? Our tool is for you! My sister and I have first-hand experience with the stress of trying to keep track of EQR’s many infractions, which is why the Landlord Reporting and Rent Debt Tool is so helpful. It’s easy to use, simply choose yes or no if a scenario applies to you. And don’t forget to pass it on to your friends, family and neighbors once you finish filling it out.

All in all, my sister and I don’t just want to survive in Los Angeles. We want to thrive in our city, not just for us, but for our friends, our neighbors and our co-workers.

The future we want to build in Los Angeles is for the people. Where the real LA is preserved and protected—not just the version sold to tourists. We want an LA where community is valued over corporations, where housing and fair wages are treated as human rights; where the artists, families, and elders who continue to build this city can actually stay in it for a lifetime. We’re imagining a city where Black and brown Angelenos are prioritized and celebrated, not pushed out and forgotten. We’re fighting for a city where private equity doesn’t profit from working class people’s pain. And the fight is just beginning.

Have you filled out the Landlord Reporting and Rent Debt Tool? If so, we’d love it if you could RSVP for our upcoming EQR Debt Defense Workshop.

I was just talking to my partner about how much I hate health care REITs, which are terrible for patients! Turns out that, in the same way, residential REITs are bad for tenants. I'm so sorry you and your sister had to go through this 😭

So inspired by y'alls leadership and vision.